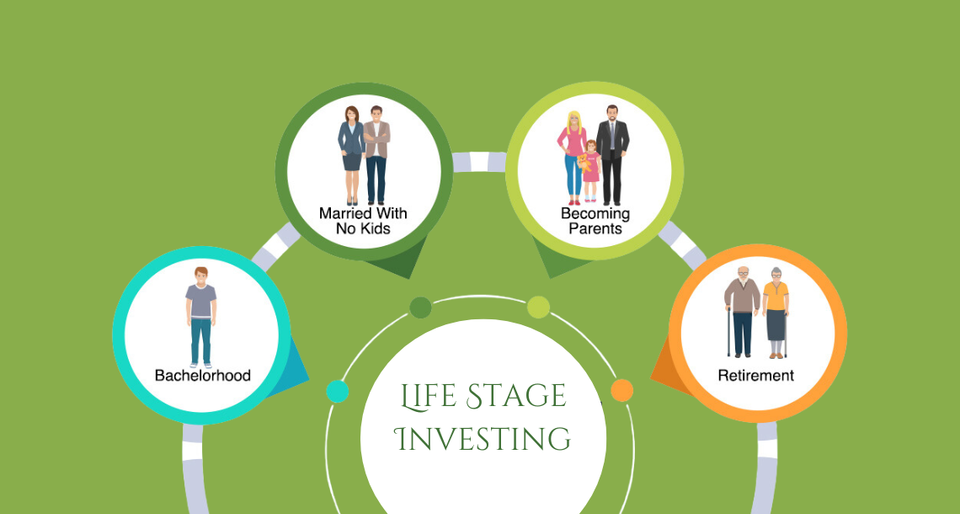

Life Stage Investing: Aligning Investments with Life’s Key Milestones

In our households, the art of saving is deeply ingrained with spending wisely. It’s a practice that often starts in childhood, as we save for toys, dollhouses, sports watches, mobile phones, or even our future dream homes. This approach to saving is formally known as life-stage saving. As savings grow, the next natural step is investing, which is referred to as life-stage investing. This investment strategy aims to cater to each life stage’s financial needs and goals.

What is Life Stage Investing?

Life stage investing encompasses four main phases: starting a career, getting married, starting a family, and retirement. Each of these stages brings its own financial responsibilities and requires a different approach to investment planning.

Factors Influencing Life Stage Investing

- Earnings and Their Origin: The level and source of your income are critical. Is your income steady or does it fluctuate? Will it be sustainable over time? These aspects heavily influence your investment approach.

- Obligations and Commitments: Your responsibilities, such as being a parent or planning for retirement, shape your investment landscape.

- Expenditures: As life progresses, so do our priorities and spending habits, which significantly impact our investment philosophies.

- Chronological Positioning: Age is a pivotal determinant in investment strategies, often dictating the level of risk one can comfortably undertake.

- Market Forces: The current market and economic conditions play an essential role in shaping investment decisions.

- Disposable Income: This is what remains after covering all your necessities and desires. It fluctuates through life based on factors such as family size and total earnings.

Life Stage Investing Strategies

Let’s delve into each stage and its corresponding investment approach.

Entering Stage 1: The Bachelorhood

Life stage investing begins when you are single. It’s that pivotal moment when you land your first job and gain financial independence. With a steady income stream, you manage your expenses—rent, groceries, transportation—and maybe even save a bit.

Goals: Your main financial priority now is to ensure your income sufficiently covers all your expenses to avoid falling into debt. If your expenses exceed your income, you must either cut back on spending or seek additional income sources.

Investing at this stage:

- Understand your financial planning goals and decide your steps accordingly.

- Save 3-6 months’ worth of living expenses in a high-yield savings account as an emergency fund.

- Start with less risky options and develop savings habits. SIPs and FDs are good options.

- Research before investing and consider options like mid-cap funds, small-cap funds, equity funds, stocks, and mutual funds.

Stage 2: Marriage

Marriage is a time of both accumulation and transition. This stage sets the benchmark for your financial planning, with a focus on shared responsibilities and goals.

Responsibilities: Building a career, accumulating wealth, and achieving milestones like buying a home.

Investing at this stage:

- Discuss and clarify goals with your partner.

- Include both long-term and short-term goals in your investment plan.

- Ensure both partners have adequate health and life insurance.

- Invest in options like mutual funds and SIPs, or take a mixed approach with lower-risk products such as bond funds.

Stage 3: Becoming Parents

Stepping into parenthood is a different experience entirely. Your expenses increase, and so do your responsibilities.

Responsibilities: Plan for your children’s education, their weddings, your retirement, and more.

Investing at this stage:

- Plan financially for your children. Open and contribute to education savings accounts.

- Increase your emergency fund to cover additional family expenses.

- Update your life insurance plans to cover your family’s financial future. Ensure comprehensive health insurance for the entire family.

- Diversify your investments with options like debt funds, fixed deposits, and hybrid funds.

Stage 4: Married with Older Children

As your children grow and your career blossoms, your focus shifts. This is a time of transition and accumulation.

Investing at this stage:

- Reevaluate and adjust your investment strategy as goals change.

- Increase contributions to your portfolio, particularly in equity, while maintaining diversification to manage risk.

- Ensure adequate health and life insurance as you near retirement.

Stage 5: Retirement

Retirement marks the start of a new chapter where you enjoy the fruits of your labor. This phase is when you can benefit from the wealth you’ve built up over the years.

Investing at this stage:

- Invest in lower-risk options like debt mutual funds. Use a Systematic Withdrawal Plan (SWP) for a steady income stream.

- Keep a portion (around 20-25%) of your portfolio in wealth-generating assets like reliable stocks and diversified equity mutual funds.

- Cut back on unnecessary expenses to build a safety net for unexpected costs, such as medical emergencies.

Life doesn’t always go as planned. Unexpected events, both positive and negative, can occur anytime. Creating a life stage investing plan might seem complex, but it’s actually simple. It’s about finding the right balance in your finances and staying aware of your situation. By doing this, you can navigate challenges and reach your financial goals. Taking control now will make it easier to build a secure future.

Frequently Asked Questions (FAQ)

1. What is life stage investing?

Life stage investing is an investment strategy that caters to the financial needs and goals at different stages of life, such as starting a career, getting married, starting a family, and retirement. It involves adjusting your investment approach based on your current life phase.

2. What factors influence life stage investing?

The main factors influencing life stage investing include:

- Earnings and their origin (steady or fluctuating income)

- Obligations and commitments (parenthood, retirement planning)

- Expenditures and changing priorities

- Chronological positioning (age and risk tolerance)

- Market forces and economic conditions

- Disposable income (after covering necessities and desires)

3. How should I invest during the bachelorhood stage?

During the bachelorhood stage:

- Save 3-6 months’ worth of living expenses in a high-yield savings account as an emergency fund.

- Start with less risky options like SIPs and FDs.

- Research and consider options like mid-cap funds, small-cap funds, equity funds, stocks, and mutual funds.

4. What should I focus on when investing after getting married?

When investing after getting married:

- Discuss and clarify financial goals with your partner.

- Include both long-term and short-term goals in your investment plan.

- Ensure both partners have adequate health and life insurance.

- Invest in options like mutual funds, SIPs, and lower-risk products such as bond funds.

5. How do I plan my investments when becoming a parent?

When becoming a parent:

- Plan financially for your children by opening and contributing to education savings accounts.

- Increase your emergency fund to cover additional family expenses.

- Update life insurance plans to cover your family’s financial future and ensure comprehensive health insurance.

- Diversify investments with options like debt funds, fixed deposits, and hybrid funds.

6. How should my investment strategy change as my children grow older?

As your children grow older:

- Reevaluate and adjust your investment strategy as goals change.

- Increase contributions to your portfolio, particularly in equity, while maintaining diversification to manage risk.

- Ensure adequate health and life insurance as you near retirement.

7. What is the best investment approach for retirement?

During retirement:

- Invest in lower-risk options like debt mutual funds and use a Systematic Withdrawal Plan (SWP) for a steady income stream.

- Keep a portion (around 20-25%) of your portfolio in wealth-generating assets like reliable stocks and diversified equity mutual funds.

- Cut back on unnecessary expenses to build a safety net for unexpected costs, such as medical emergencies.

8. How can I prepare for unexpected life events in my investment strategy?

To prepare for unexpected life events:

- Build and maintain an emergency fund.

- Regularly review and adjust your investment strategy based on changing circumstances.

- Ensure comprehensive insurance coverage for health and life.

- Stay informed about market and economic conditions to adapt your investments accordingly.

9. Why is it important to have a life stage investing plan?

Having a life stage investing plan helps you align your investments with your financial needs and goals at different life stages. It ensures that you are prepared for various financial responsibilities and can navigate challenges effectively to reach your long-term financial objectives.

10. How can I start investing with Fynocrat?

To start investing with Fynocrat, you can plan your investments with us. We offer personalized investment strategies and professional guidance to help you achieve your financial goals at every stage of life.

Member discussion