Riding the Waves: Understanding Uptrends, Downtrends, and Horizontal Trends in Simple Terms

Embarking on the journey of investing or trading can sometimes feel like navigating a vast ocean of numbers and charts. But fear not! In this blog, we're going to demystify some key concepts that act as your compass in the financial seascape—uptrends, downtrends, and horizontal trends. So, grab your life vest, and let's set sail into the world of market trends!

Uptrends - Riding the Wave of Positivity

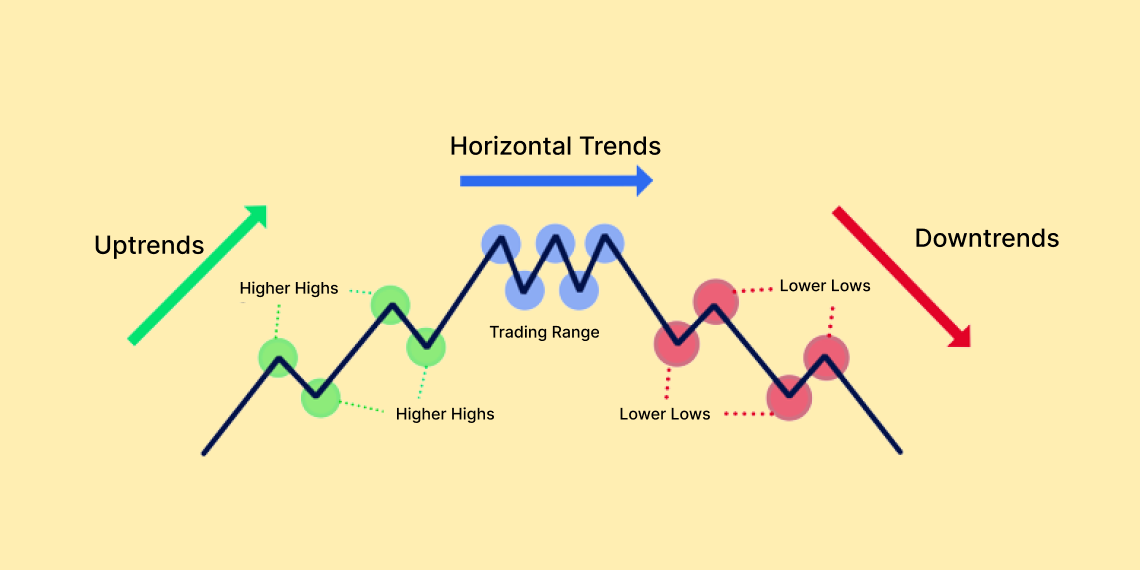

Picture this: the sun is shining, birds are chirping, and your investment is on a joyous journey upward—that's an uptrend! In simple terms, an uptrend occurs when the prices of stocks or assets consistently rise over time. It's like catching a wave of positivity, where each high is higher than the one before. Investors often aim to ride these waves, hoping the trend continues in their favor.

Downtrends - Navigating the Stormy Waters

Now, imagine a storm rolling in, waves crashing against the boat, and a bit of turbulence in your investment portfolio—that's a downtrend. In downtrends, prices consistently head southward, forming a series of lower lows. Investors might see this as a warning sign to reevaluate their strategy or even consider jumping ship. It's all about weathering the storm until clearer skies appear.

Horizontal Trends - Sailing in Calm Waters

If uptrends are like catching positive waves and downtrends are weathering storms, then horizontal trends are like sailing in calm waters. Also known as sideways trends, this scenario happens when prices move within a relatively narrow range. It's like the market taking a breather, neither surging nor plummeting. Traders often find opportunities during these periods of stability, patiently waiting for the next big wave.

Understanding uptrends, downtrends, and horizontal trends is like becoming a seasoned sailor in the financial seas. Recognizing these patterns can empower you to make more informed decisions about when to ride the wave, when to seek shelter, and when to enjoy the calm waters. So, whether you're a novice or a seasoned investor, may your journey in the world of trends be filled with profitable waves and smooth sailing!

Frequently Asked Questions (FAQ)

1. What is an uptrend in the stock market?

An uptrend occurs when the prices of stocks or assets consistently rise over time. It's characterized by a series of higher highs and higher lows, indicating a general upward movement in the market.

2. How can I identify an uptrend?

You can identify an uptrend by looking at a stock chart and noticing if each successive peak and trough is higher than the previous ones. Tools like moving averages can also help confirm an uptrend.

3. What is a downtrend in the stock market?

A downtrend is when the prices of stocks or assets consistently fall over time. It is characterized by a series of lower highs and lower lows, indicating a general downward movement in the market.

4. How can I identify a downtrend?

You can identify a downtrend by observing if each successive peak and trough is lower than the previous ones on a stock chart. Indicators like moving averages and trendlines can help confirm a downtrend.

5. What is a horizontal trend in the stock market?

A horizontal trend, also known as a sideways trend, occurs when the prices of stocks or assets move within a relatively narrow range without a clear upward or downward direction. It indicates a period of stability in the market.

6. How can I identify a horizontal trend?

You can identify a horizontal trend by observing a stock chart where the price moves within a narrow range, forming a series of highs and lows that are relatively equal. This creates a flat or sideways pattern.

7. Why is it important to understand market trends?

Understanding market trends helps investors and traders make informed decisions about when to buy, hold, or sell assets. Recognizing trends can enhance your strategy and improve the timing of your investment decisions.

8. How can I use trends to my advantage in investing?

By identifying trends, you can align your investment strategy with market movements. For instance, buying during an uptrend and selling during a downtrend can potentially maximize profits and minimize losses.

9. What tools can help me identify market trends?

Several tools can help identify market trends, including moving averages, trendlines, and technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD).

10. What should I do during an uptrend?

During an uptrend, investors often look to buy or hold their investments to capitalize on the rising prices. It's essential to monitor the trend's strength and be prepared to adjust your strategy if signs of reversal appear.

11. What should I do during a downtrend?

During a downtrend, investors might consider selling or reducing their holdings to minimize losses. It's crucial to analyze the trend's intensity and consider whether the downturn is temporary or indicative of a more extended decline.

12. What should I do during a horizontal trend?

During a horizontal trend, traders often look for opportunities to buy low and sell high within the range. It's a period for careful observation and strategic positioning, waiting for a breakout or breakdown to signal the next major trend.

13. Can trends change direction suddenly?

Yes, trends can change direction due to various factors, including economic news, company performance, and market sentiment. It's essential to stay informed and be prepared to adjust your strategy when trends shift.

14. How long do trends typically last?

The duration of trends can vary widely. Some trends may last for weeks or months, while others can persist for years. It's crucial to regularly analyze the market and adapt to changing conditions.

Member discussion