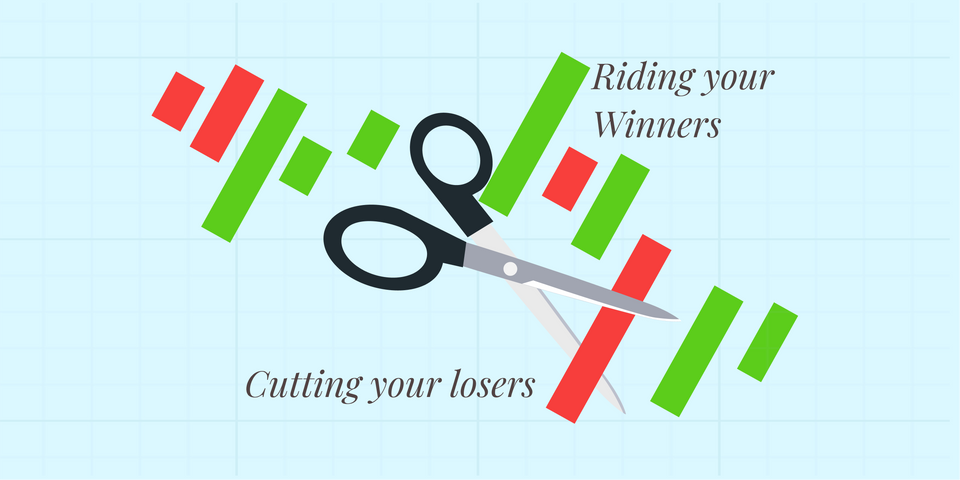

"Ride the Winners, Cut the Losers" Investing Approach

Investing in the stock market can be a daunting task, especially for newcomers. The ever-changing market dynamics and unpredictable nature of investments can make it challenging to achieve consistent returns. However, one investing approach that has gained popularity and proven to be effective is "Ride the Winners, Cut the Losers." This strategy emphasizes maximizing gains by holding onto winning stocks while swiftly selling underperforming ones. In this article, we will delve into the key principles of this approach and explore how it can enhance your investment journey.

Identifying Winning Stocks

The first step in the "Ride the Winners, Cut the Losers" approach is identifying winning stocks. This requires a thorough analysis of a company's fundamentals, industry trends, and overall market conditions. Look for companies with strong financials, a competitive edge, and a track record of consistent growth. Additionally, consider broader market factors that could influence the stock's performance. By identifying winning stocks from the outset, you increase the likelihood of experiencing substantial gains.

Holding onto Winners

Once you've identified a winning stock, it's crucial to stay invested and ride the upward momentum. Avoid the temptation to sell too early in search of quick profits. Instead, maintain a long-term perspective and let your winners continue to grow. History has shown that some of the most successful investments have been held for several years, allowing investors to capitalize on the compounding effect and exponential growth.

Cutting the Losers

The "Cut the Losers" aspect of this approach is equally significant. Not every investment will be a winner, and it's essential to recognize when to exit a losing position. Set clear criteria for determining when to sell a stock that's underperforming or displaying unfavorable trends. This could include factors such as deteriorating financials, adverse market conditions, or a significant change in the company's competitive landscape. By cutting your losses early, you free up capital to reinvest in more promising opportunities.

Continuous Monitoring and Adaptation

Successful implementation of the "Ride the Winners, Cut the Losers" approach requires ongoing monitoring of your portfolio and the market. Stay updated on news and events that could impact your investments. Regularly reassess the performance and prospects of the companies you're invested in, and be prepared to make adjustments when necessary. This approach requires a proactive mindset, and flexibility is key to adapt to changing market dynamics.

Conclusion

The "Ride the Winners, Cut the Losers" investing approach is a powerful strategy that allows investors to maximize gains and limit losses. By identifying winning stocks, holding onto them, and implementing effective risk management techniques, you can increase your chances of achieving consistent returns. Simultaneously, being willing to cut your losses and adapt to market changes helps protect your capital and minimize potential downturns. Remember, successful investing requires discipline, patience, and continuous learning. Embrace this approach, develop a sound investment plan, and enjoy the journey towards financial prosperity.

FAQ

1. What is the "Ride the Winners, Cut the Losers" investing approach? The "Ride the Winners, Cut the Losers" approach is an investment strategy that focuses on maximizing gains by holding onto stocks that are performing well and selling stocks that are underperforming. The goal is to capitalize on winning investments while minimizing losses from poor performers.

2. How do I identify winning stocks? Identifying winning stocks involves thorough analysis of a company's fundamentals, such as financial health, competitive advantage, and consistent growth. Additionally, consider industry trends and overall market conditions that could influence the stock's performance. Look for companies with strong financials and a proven track record of success.

3. Why is it important to hold onto winning stocks? Holding onto winning stocks allows you to benefit from long-term growth and the compounding effect. Selling too early in search of quick profits can result in missed opportunities for substantial gains. A long-term perspective helps you ride the upward momentum and maximize returns.

4. When should I sell underperforming stocks? Set clear criteria for determining when to sell underperforming stocks. This could include deteriorating financials, adverse market conditions, or significant changes in the company's competitive landscape. Recognizing when to exit a losing position helps you free up capital to reinvest in more promising opportunities.

5. How often should I monitor my investments? Successful implementation of this approach requires continuous monitoring of your portfolio and market conditions. Stay updated on news and events that could impact your investments. Regularly reassess the performance and prospects of the companies you're invested in and be prepared to make adjustments as needed.

6. What are the key benefits of the "Ride the Winners, Cut the Losers" approach? The key benefits include maximizing gains from well-performing stocks, minimizing losses from poor performers, and protecting your capital. This approach also promotes disciplined investing, as it encourages holding onto winners and making informed decisions about when to cut losses.

7. What are the potential risks associated with this approach? Potential risks include the possibility of misidentifying winning stocks, selling winners too early, or holding onto losers for too long. Market volatility and unexpected events can also impact the performance of your investments. Continuous learning and adaptability are essential to mitigate these risks.

8. How can I develop a sound investment plan using this approach? Developing a sound investment plan involves setting clear criteria for identifying winning stocks, establishing rules for when to sell underperforming stocks, and continuously monitoring your portfolio. Consider diversifying your investments to spread risk and stay informed about market trends and news.

9. Is this approach suitable for all investors? The "Ride the Winners, Cut the Losers" approach can be suitable for both novice and experienced investors. However, it requires discipline, patience, and a proactive mindset. Investors should be comfortable with continuous monitoring and willing to adapt to changing market dynamics.

10. Can I use this approach with other investment strategies? Yes, this approach can be combined with other investment strategies to create a diversified and balanced portfolio. For example, it can complement value investing, growth investing, or income investing by providing a framework for managing winners and losers within your broader investment strategy.

Member discussion