How Dividend Yield Reflects Stock Performance and Income

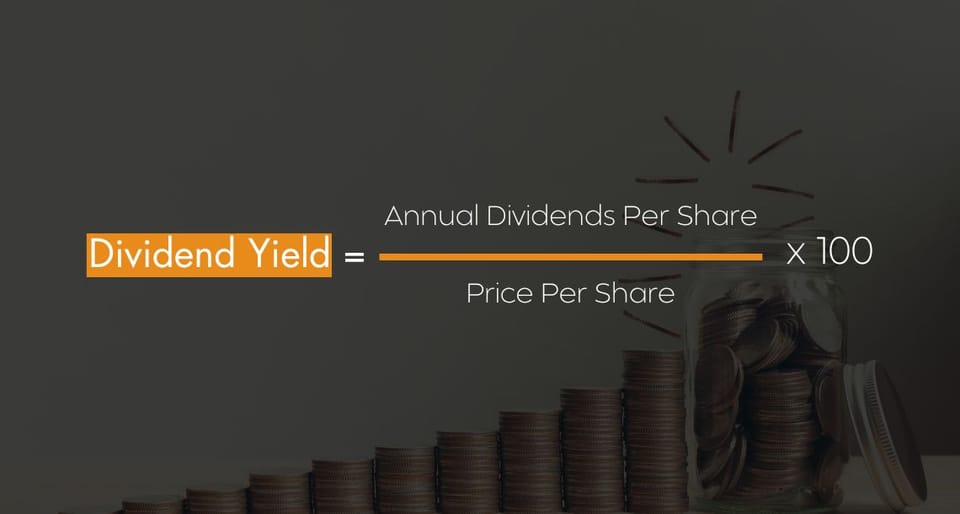

Dividend yield is a financial ratio that measures how much a company pays out in dividends each year relative to its stock price. This metric is particularly significant for income-focused investors as it provides a clear indication of the potential income return on an investment in a stock, irrespective of market volatility.

Significance of Dividend Yield

- Income Indicator: A high dividend yield can indicate a lucrative income stream from dividends relative to the stock price, appealing particularly to those seeking regular income from their investments.

- Stock Performance Insight: While a higher yield might be attractive, it could also signal that the stock price has fallen due to underlying issues within the company. Conversely, a low dividend yield could indicate a rising stock price or a company that retains more of its earnings for growth.

- Market Sentiment: Changes in dividend yield can reflect shifts in market sentiment towards a company. An increasing yield may attract income investors, while a decreasing yield could deter them.

Dividend Yield in Evaluating Investments

Dividend yield should be considered in the context of the company’s dividend history, payout ratio, and the stability of dividends. A company with a consistently high payout ratio and stable dividend payments can be a reliable source of income.

Limitations of Dividend Yield

- Not a Standalone Metric: Dividend yield doesn’t account for stock price appreciation, which can be a significant part of total returns.

- Economic Impacts: External economic factors such as interest rate changes can influence dividend yields. Higher interest rates, for instance, may make bonds more appealing than high-dividend stocks.

- Company Fundamentals: A high yield does not necessarily indicate a good investment. It’s essential to assess the company’s overall financial health to ensure that it can sustain its dividend payments.

Dividend yield is a critical metric for assessing both the income-generating ability and the potential risk associated with investing in a stock. While it can provide valuable insights, investors should use it in conjunction with other financial analyses to get a comprehensive view of an investment's potential. This approach ensures a balanced perspective on both the income and growth prospects of a stock.

FAQs

Q1: What is considered a good dividend yield?

A1: The definition of a "good" dividend yield varies by industry and economic climate, but typically, a yield between 3% and 6% is considered attractive while also suggesting stability.

Q2: Can dividend yield be too high?

A2: Yes, an excessively high yield can be a red flag, potentially indicating a troubled company whose stock price has fallen significantly, thus inflating the yield.

Q3: Is a higher dividend yield always better?

A3: Not necessarily. A higher yield is better for income if sustainable, but the reasons behind a high yield—like a declining stock price—need to be understood.

Q4: How does dividend yield affect total return?

A4: Dividend yield can significantly contribute to the total return, especially in stable markets where stock price gains are modest.

Q5: Should I reinvest dividends or take the cash?

A5: This depends on your investment goals. Reinvesting dividends can lead to compounding returns over time, while taking the cash provides immediate income.

Member discussion